If you don’t understand hedge funds here’s a Cliff’s Notes version:

- A hedge fund is a pooled investment structure set up by a money manager designed to make a return on capital.

- A hedge fund isn't a specific type of investment, but rather a vehicle for investment.

- Big Hedge Funds use capital from accredited investors (High Net Worth Individuals, Pension Funds, Charitable Foundations, University Endowments) to execute various market transactions.

- Often the types of transactions involve risky instruments such as short selling, leverage, derivatives (puts, calls, options, futures) intended to “hedge” the risk exposure of the fund’s capital and make money in the process.

- A fund’s transactions often involve arbitrage (the buying and selling of the same asset in order to profit from a difference in the asset's price between markets).

If you understand this then you understand everything that’s wrong with capitalism today: we’ve removed capitalists from capitalism and replaced them with financiers – there is nothing being made aside from money; there is no product being made, no service being provided, only money changing hands. We’ve replaced the wheels of industry with the wheels of finance.

What happened last week, forcing a couple of hedge funds to liquidate was the result of a proletariat uprising. Retail traders -i.e. ‘day traders’ - generally with a portfolio between $500 to $2,500 - took down two billionaire hedge funds by buying the GameStops shares the hedge funds were shorting. Now when huge funds short a stock they not only hope it will go down, but they are instrumental in driving it down by triggering momentum buyers. What the retail traders on Reddit did was change the game by creating momentum in the opposite direction by buying up all the stock that the hedge funds dumped (that they don’t own remember, they ‘borrowed’ it to sell short) on the market.

They manipulated the market on the same stock the hedge funds were trying to manipulate only in the opposite direction, thereby bankrupting the funds as they had to buy the stocks they had already sold for $4(remember, they didn’t own them, they ‘borrowed’ them) at $400 a share. Ouch!

I posted this last night, but it still has me chuckling this morning:

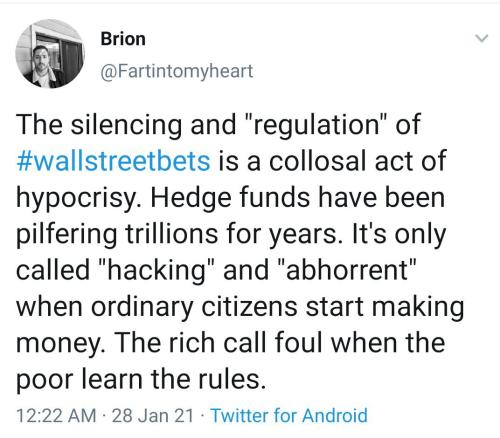

Of course the elitists immediately sprung into action:

- On Wednesday, the platform Discord banned the r/wallstreetbets server, alleging it violated its hate speech policies (from here-to-forth the preferred route of cancelling everything the elitists dislike for whatever reason).

- Trading of GameStop, AMC and other stocks targeted by retail traders was suspended on many brokerages, including Robinhood, Interactive Brokers, Charles Schwab, and TD Ameritrade.

- Wall Street and Congress immediately called for a stop and protection from this small group of individuals trying to break and change the rules of the system so that they always win and can’t ever lose (like the big guys have been doing for decades now). Why, it’s anticapitalist, they thundered!

But oddly enough, this is how free market capitalism in suppose to work, the little guys banding together to keep the big guys in check, using the same rules of the system everybody plays by. No laws were broken, nothing was rigged.

Ironic, isn’t it, that the stock that brought down a couple of billionaire market gamers was “GameStoppers.”